Download Sales Off to Terrible Start in 2014

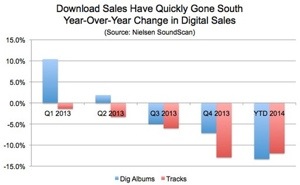

U.S. digital sales are beginning 2014 just like they ended 2013: in negative territory. Through the third week of the year, track sales are down 11.9% and digital album sales are down 13.3%, according to Nielsen SoundScan. Both figures stand in stark contrast to the same period last year. Through the first three weeks of 2013, track sales were up 2.2% and digital album sales were up 18.1%.

Related Articles

What’s Behind the Digital Download’s Decline and Can Streaming Save the Day? (From The Magazine)

The Download Hits Middle Age (and It Shows)

These numbers strongly suggest American consumers are quickly changing how they experience digital music. There are signs of change outside of sales numbers. Beats Music apparently had a strong debut this week — its overloaded system has resulted in spotty service — and reached No. 2 on iTunes’ list of free iPhone apps. Netflix’s fourth quarter exceeded expectations. The streaming video service now has 31.7 million subscribers in the United States and another 9.7 million elsewhere. Pandora’s popularity is an ongoing reminder that streaming is mainstream. The Internet radio service had 76.2 million monthly users at the end of December.

iTunes Radio launched in the second half of 2013. Last week, Rdio debuted unlimited, advertising-supported listening. The much-awaited Beats Music launched this week and apparently has an unexpectedly large number of people signing up for paid or free trial accounts. On Wednesday, Beats Music halted new registrations to fix bugs and has been the second-most-downloaded free iPhone across all categories, according to App Annie.

Digital revenues will be under pressure if download sales end the year down 12.6%, the decline of track-equivalent album (TEA) sales in the first three weeks of the year. A 12.6% decline of revenue would equal a loss in the ballpark of $240 million of trade value and $340 million in consumer spending. In this scenario, a major label group with a 25% market share could expect download revenue to decline about $60 million this year.

But there’s reason to believe digital sales will worsen as the year progresses. If downloads follow the trend established last year, download sales will finish the year in even worse shape. Over the last 12 months, track and digital album sales consistently weakened last year. Track sales were down just 1.3% in the first quarter of 2013 but were down 3.3%, 6% and 12.9% in the successive three quarters. Digital albums had an even greater tumble, going from a 10.4% increase in the first quarter of 2013 to a 7.1% deficit in the fourth quarter.

The pace of download sales’ decline is probably faster than labels and publishers would like to see. After all, the download was a growth format for a decade and helped offset losses from declining CD sales. But the decline in download revenue can be offset — and likely overcome — by gains in streaming revenue. Between on-demand video services like YouTube and Vevo, Internet radio services such as Pandora and a host of on-demand subscription services, hundreds of millions of incremental digital revenue should be realized in the United States this year.

The cycle is clearly evident: the growth of streaming services negatively impacts digital purchases and puts additional pressure on the music business to generate new revenue by growing streaming services. Rinse and repeat.