The Next Era of the Music Business

Regardless if you’re a musician or music consumer, your music life is about to change. Slowly but surely digital music distribution has been evolving from downloads to streaming, but that transition has been really picking up speed over the last 12 months. With Spotify leading the way thanks to reams of publicity, more and more consumers are finding that the joy of renting music beats owning it by a long shot.

While it’s been long rumored that Apple has their own streaming service up their sleeve, several developments reveal the change that is about to come.

First is the fact that Jimmy Iovine’s Daisy project (named after the first computer generated song) just received a $60 million injection from the likes of Warner Music Group’s owner Len Blavatnik, Fort Worth billionaire Lee Bass and Australian financier James Packer. This is a serious investment by some deep pockets that know what they’re doing and don’t like to lose. Then comes word that Apple’s Tim Cook recently took a meeting with Iovine to be briefed on the project. Does that mean a collaboration? We don’t know, but at the very least, Apple has a good working relationship with Iovine, since he was one of the first to sign Universal Music onto iTunes back in 2001. Together they’d be a powerhouse, a true 1200 pound gorilla. Chances are that Apple will chose to go it alone and just stay at 800 pounds though. It doesn’t need a partner, but if there’s something there worth buying, they have lots of money.

Then comes word that Google has been quietly making deals with all the major labels for their own YouTube-based subscription streaming service to be launched later in the year.

If all this were happening a couple of years ago we would’ve looked to only one of these prospective services to be left standing at some point, with the others falling by the wayside. But this is a different time, with the streaming business far more mature thanks to the likes of Spotify, Pandora, Rdio, Slacker, et al. It’s now probably possible that all of these new services survive if they’re at least half-way decent in their user operation and offerings.

This is definitely going to be a big win for consumers, with nearly an unlimited selection of songs available for a relatively small monthly fee (not sure what the price point will end up being, but $9.95 keeps being mentioned). Consumers are quickly seeing the advantages of renting their music.

It will be a different story for artists and songwriters however. By now everyone knows how little the royalty can be from a stream, with stories abounding about income lost by the writer and artist. Although a full transition to streaming will be a godsend for the labels, with steady monthly income actually bolstering their bottom line, you can bet that not much of that will trickle down to the artists – at least at first.

It’s not going to happen overnight, but within a matter of time, you’ll see the entirety of the management and law categories of the music business devise a better way to get paid, and eventually force the labels to fall in line. And when that happens, it will trickle down to the DIYers who insist on doing it their way. To what degree this all takes place, we’ll have to wait and see.

While we’re currently in the era of Music 3.0, we’re about to see the next stage of the music business. Welcome to Music 3.5!

Via Music Think Thank & AlLindstrom

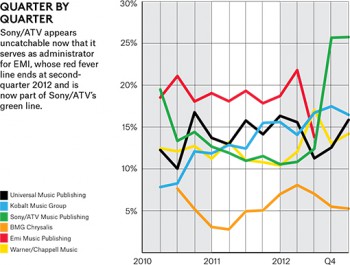

Sony/ATV Top Publisher for 2012′s Fourth Quarter

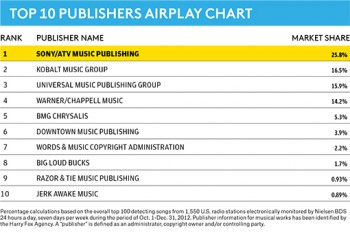

In what likely will be a trend for the next few years, Sony/ATV is the No. 1- ranked music publisher, based on its market share of the top 100 songs as compiled by Nielsen BDS.

For the fourth quarter, Sony/ATV, which includes administration for EMI Music Publishing, posted a share of 25.8%, which is up slightly from the 25.7% share that the combined entity tallied in the third quarter. On June 29, 2012, a Sony Corp. of America-led consortium completed the acquisition of EMI Music Publishing and assigned the company to Sony/ATV for administration.

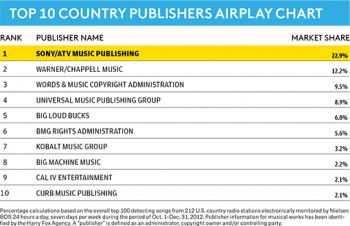

In the fourth quarter, Sony/ATV, which also took the No. 1 ranking in the top 100 country songs with a 22.9% share, claimed a stake in 52 of the top 100 tracks, including Rihanna’s “Diamonds” (No. 2), fun.’s “Some Nights” (No. 3) and Ne-Yo’s “Let Me Love You (Until You Learn to Love Yourself)” (No. 5). In the prior quarter, the two combined song portfolios had a piece of 53 songs among the top 100.

For the second consecutive quarter, Kobalt Music Group ranked second, with 16.5% in the fourth quarter, which is down from the 17.5% it posted in the third quarter but up from the 15.6% it had in fourth-quarter 2011. For fourth-quarter 2012, Kobalt placed 25 tracks in the top 100 songs, down from 29 in the third quarter. Kobalt’s shares included Maroon 5’s No. 1 track, “One More Night”; “Diamonds”; and Ke$ha’s “Die Young” (No. 7).

Universal Music Publishing Group continues to be on the rise, this time moving up in the rankings to No. 3, with a 15.9% share, versus the 12.6% it had in the third quarter when it ranked fourth. In fact, that third-quarter tally marked an improvement from the second quarter, when UMPG had an 11.3% share. But it’s down from the 16.3% it had in fourth-quarter 2011, when it was ranked No. 2 behind EMI.

For fourth-quarter 2012, UMPG had a piece of 39 songs among the top 100, up from the 35 it had in the third quarter. Its top songs included “One More Night,” Bruno Mars’ “Locked Out of Heaven” (No. 4) and “Let Me Love You.”

Even though it gained in market share, Warner/Chappell Music fell to No. 4 from No. 3 in the third quarter when it had 13.1%. For fourth-quarter 2012, Warner/Chappell posted 14.2% and placed 32 tracks in the top 100, down from 37. But that’s better than the No. 5 ranking it had in fourth-quarter 2011, when it had 10.4%. W/C’s top songs included “Some Nights,” “Locked Out of Heaven” and Alex Clare’s “Too Close” (No. 6).

BMG Chrysalis ranked fifth, the same as in the third quarter, with its market share falling slightly to 5.3% from 5.5%. BMG had a share in 18 of the top 100 songs, including “Locked Out of Heaven,” Chris Brown’s “Don’t Wake Me Up” (No. 11) and Ellie Goulding’s “Lights” (No. 18). In fourth-quarter 2011, BMG had a 7% share and ranked No. 6.

For the fourth consecutive quarter, Downtown Music Publishing appears in the rankings, this time at No. 6 with 3.9%, up from the 2.7% it had in the third quarter. In finishing sixth, Downtown placed eight songs in the top 100, one more than the prior quarter. Its songs included “Don’t Wake Me Up” and Phillip Phillips’ “Home” (No. 12).

Also on a four-consecutive-quarter streak is Words & Music Copyright Administration, which ranked No. 7 with a 2.2% share based on the five tracks it placed in the quarter’s top songs, which included Carrie Underwood’s “Blown Away” (No. 36).

Big Loud Bucks posted a 1.7% share, good enough to return the publisher to the rankings for the first time since second-quarter 2009. In placing eighth, Big Loud Songs had six tracks among the top 100, including Florida Georgia Line’s “Cruise” (No. 24) and “Blown Away.”

Razor & Tie’s piece of “Home” places the publisher at No. 9 with a 0.93% share — a drop from the 1% it had the last time it was in the top 10 in fourth-quarter 2011.

Rounding out the rankings, Jerk Awake Music’s share in Demi Lovato’s “Give Your Heart a Break” (No. 43) kept the company in the top 10 for a second consecutive quarter, with 0.89%.

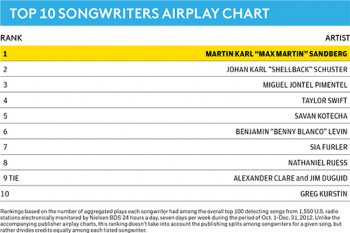

Martin Karl “Max Martin” Sandberg was the top songwriter for the quarter with a share in six songs among the top 100, including “One More Night,” Taylor Swift’s “We Are Never Ever Getting Back Together” (No. 8) and Katy Perry’s “Wide Awake” (No. 20). [Billboard.biz]