ESMG WebCrew

Posts by Mikael Gustavsson:

Major Labels See Decline In Global Market Share As Independents Grow

In an annual survey taken by Music & Copyright, it’s been revealed that three of the four major labels—Universal Music Group, Warner Music Group, Sony Music Entertainment, and EMI—suffered a decline in global market share. These deficits can be traced to a rise in global market share within the independent music industry.

According to the survey, Universal Music Group’s global market share dropped from 28.7 percent in 2010 to 27.9 percent in 2011; Sony Music Entertainment, 23 percent to 21.9 percent; and EMI, 20.2 percent to 19.9 percent. Warner Music Group was the only major label to see an increase in GMS with .02 percent.

Collectively, independent labels saw a 2 percent increase in GMS, putting them at 25.2 percent.

Despite a .08 percent deficit in global market share, Universal Music Group still earned the most revenue through sales, publishing, and licensing.

As more artists like Mac Miller continue to debut at No. 1 on the charts without the help of a major label, expect independent music to continue to thrive in the coming years.

For the full report, head on over to the Music & Copyright blog.

Concert Awareness Is Booming. So Why Is Attendance Declining?

Awareness, or lack thereof. It’s traditionally been the biggest reason why people miss concerts from their favorite artists. Right in their own backyards. Which is the driving motivation behind heavily-funded startups like Songkick, and recently-launched concepts like Live Nation’s Facebook app, Concert Calendar. Because people tend to listen, like, and acquire music from their favorite artists online, which means it’s now easier than ever to identify and alert those fans of an upcoming show.

In fact, it’s now harder than ever – in the history of live events – to miss a show. But if this is such a revolutionary moment for live events, why are fewer and fewer people actually going to shows?

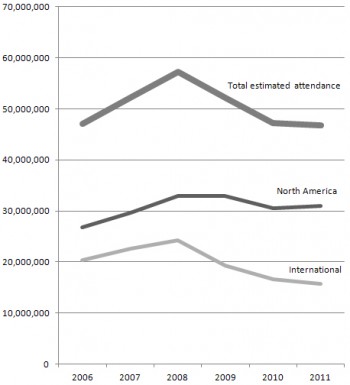

Here’s a breakdown of concert attendance from Live Nation, which shows a decrease in attendance over the years. That is, despite the surge in totally-connected apps and alert systems. In fact, since Songkick hit the stage in 2007 (and since received $16.5 million in funding), Live Nation’s global attendance has dropped 10.4 percent. And in-between, Live Nation itself has been steadily ratcheting its social networking initiatives, most notably on Facebook.